Business

Financial PlanningBusiness Planning

Whatever vision you have for your business and financial future, it takes the right strategy to make it happen. Over the course of many years helping business owners address their financial concerns, we’ve learned first-hand what works and what doesn’t work. We offer a process that provides the framework to uncover opportunities, maximize results, and put you on a solid path to achieving all that is important to you.

Why Financial Planning is Important for Your Business

The idea of starting a business and being in business for oneself is an aspiration for many people. It comes with independence, flexibility, and endless opportunities. But, it also comes with growing pains, obstacles, and liabilities.

Business planning goes beyond the scope of business operations and sales. It goes beyond identifying your customers, and providing the best services or products to outperform the competition.

Business planning is creating and acting on your visions to meet the company’s goals without worrying about any unexpected event that you have little control over. A great business owner prepares for the future to help ensure their business can weather all that lies ahead.

Your business deserves the type of planning that allows you to reap the benefits of your hard work after years of dedication and commitment with minimal disruption.

Financial Planning

The Gap in Business Planning

Strategies for business owners often focus on current challenges and specific financial products, and may fail to coordinate solutions that address the key issues we know all business owners face. Chief among those issues – preparation for the eventual day you leave your business. Even though all owners will leave their businesses, our experience has been that most haven’t planned for it.

Ask yourself…

Your Business.

Your Life.Business Continuation

Business Valuation

Life Insurance

Employee Stock Ownership

Key Person Insurance

Buy-Sell Plan Agreement

Interdependent

Decisions.In order to make your business the success it is, things like personal retirement planning, mortgage selection, cash flow and insurance decisions may potentially suffer if they are not seen as equally important. The challenges of balancing your business planning and your personal planning could result in missed opportunities or poor decision-making.

Coordination is Key.

As a business owner, you may be contracting with a number of professionals to provide for your family and your employees. For instance, different professionals may be providing property and casualty insurance, retirement plans or personal life insurance. You may have someone completely different handling a group benefit plan for your employees.

The task of coordinating the strategy behind these financial decisions, their implications, and the costs is left entirely up to you.

In order to understand the effects of your financial decisions, streamline costs, and plan for your future, you need an organized and integrated view of your financial decisions across your business and personal life. A comprehensive perspective will help you maximize protection, minimize cost, and provide a barrier to protect your business and your personal assets.

As distinctly important as your business is, in certain ways it cannot be separated from your personal balance sheet.

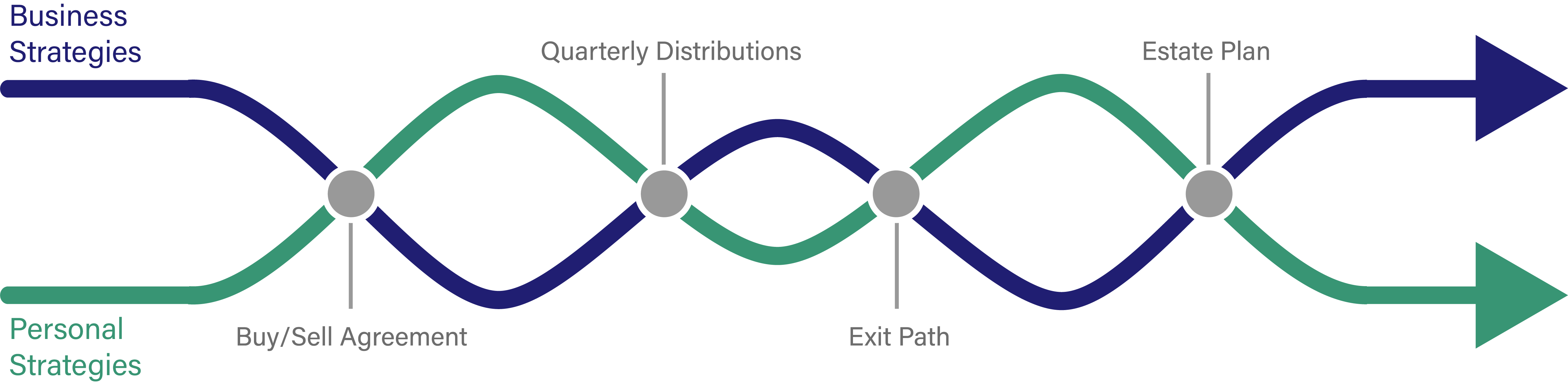

There are key moments when business and personal planning strategies typically intersect.

As the planning process evolves, coordination of efforts to maximize your business and personal balance sheets will become evident. You could find clarity in:

- The impact that an unexpected event in the business would have on your personal situation.

- Your post-exit strategy to create cash flow that is substantial, tax-efficient and insulated from risk.

- A plan to coordinate your exit strategy with your personal legacy goals for family, charitable causes, and the business itself.